Stagflation: The Economic Threat Looming Over America

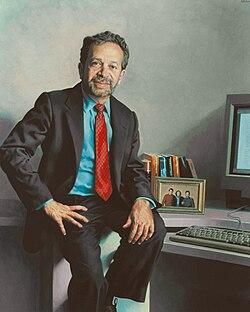

In light of the evolving political climate and the economic hurdles confronting the United States, prominent economist and former Labor Secretary Robert Reich has issued a grave caution: the risk of stagnation combined with inflation—known as stagflation—could become a significant concern as the nation deals with repercussions from Trump’s administration. As discussions surrounding fiscal strategies, employment growth, and corporate responsibility heat up, Reich emphasizes that unresolved economic challenges intensified during Trump’s presidency may linger for years. This article delves into Reich’s perspectives on Trump’s ‘downfall’ and highlights the urgent need for effective interventions to prevent an extended economic downturn.

Economic Instability: The Role of Trump’s Policies in Creating Stagflation Risks

The consequences of Donald Trump’s economic strategies are becoming increasingly apparent as fears regarding stagflation—a concerning mix of stagnant growth alongside rising prices—emerge. During his administration, Trump advocated for tax reductions and deregulation under the premise that these measures would stimulate economic expansion. However, critics like Robert Reich argue that such policies may have set a precarious foundation for future economic instability. The persistent increase in living costs paired with minimal wage growth and declining consumer confidence creates an alarming scenario reminiscent of challenges experienced in previous decades. With potential recessionary signs on the horizon, historical lessons are crucial to understanding how current policies could lead to similar outcomes.

A few pivotal elements deserve attention as we navigate this complex landscape:

- Inflationary Trends: Escalating prices for necessities such as fuel, groceries, and housing are straining household budgets while simultaneously dampening consumer spending—a vital driver of economic progress.

- Economic Stagnancy: Low GDP growth rates can deter investment opportunities and innovation efforts, fostering an environment where unemployment remains high.

- Pivotal Policy Actions: The Federal Reserve’s possible responses to rising inflation—including potential interest rate increases—might inadvertently hinder further growth exacerbating existing issues.

| Year | % Change in GDP Growth | % Inflation Rate | |||

|---|---|---|---|---|---|

| 2019 | 2.3% | 1.8% | |||

| 2020 | < td > -3 .4 % td >< td > 1 .2 % td > tr >< tr >|||||

| 2022 | < t d >

| Inflatio n Rate< / t d >< ; t d > ;6 .5%< ;/ t d > ;< ; t d > ;↑8% (estimate)</t d></ tr> | ||

| Unemploymen t Rate< / t d >& lt ; | 4%< ; /t d >& lt ; | ↑5 . 5%< ; /t dtg;<td><td> |

| Consumer Spending< ;

/t dtg;<td>Growth : 2% /t dtg;<td>↓1% /t dtg;<td> |

The specter surrounding stagflation necessitates prompt action from policymakers aiming at enhancing our economy’s resilience effectively.

By emphasizing, we can generate jobs while simultaneously boosting national productivity over time.

Moreover prioritizing, will draw private sector investments ensuring sustainability which becomes increasingly important given shifting global energy demands.

To stabilize our economy governments should explore implementing, providing immediate assistance specifically directed toward sectors most impacted facilitating quicker recoveries whilst ensuring funds reach those who require it most.

Additionally addressing shortcomings within labor markets proves essential too.

Policymakers ought invest heavily into skills training programs equipping workers adequately preparing them better suited towards rapidly evolving economies especially focusing technology renewable sectors

Efforts must also be made accommodating flexible work arrangements helping maintain productivity even during downturns

Furthermore strengthening regulatory frameworks protecting consumers ensuring fair competition mitigates adverse effects stemming from volatility present within economies today.

With these recommendations elected officials possess tools necessary not just avert impending crises but pave pathways leading toward more resilient futures economically speaking!

ConclusionIn summary Robert Reich’s evaluation concerning Donald Trump’s presidency reveals stark realities regarding forthcoming financial obstacles awaiting us all ahead!

As apprehensions around potential occurrences related specifically tied back again onto aspects involving stagnated conditions coupled together alongside heightened price levels rise steadily so do implications felt directly impacting everyday Americans lives profoundly!

Navigating through complexities inherent throughout this landscape requires astute decision-making capabilities among leaders tasked guiding us forward successfully avoiding long-lasting damages inflicted upon society itself!

Ultimately achieving stability necessitates vigilance cooperation commitment tackling root causes underlying volatility faced amidst uncertain times ahead!