US President Donald Trump isn’t satisfied about the way in which some nations are taxing Americans and firms. He has made transparent he’s prepared to retaliate, threatening to double taxes for their very own electorate and firms.

Can Trump in reality do this, unilaterally, as president? It seems he can, below a 90-year-old provision of america tax code – Segment 891.

In an govt memo signed on January 20 outlining his “America First Trade Policy”, Trump prompt US Treasury to:

examine whether or not any international nation topics United States electorate or companies to discriminatory or extraterritorial taxes pursuant to Segment 891 of Identify 26, United States Code.

A sweeping energy

Segment 891 of america Interior Earnings Code is brief, however it’s in sweeping phrases.

If the president reveals that US electorate or companies are being subjected to “discriminatory or extraterritorial taxes” below the rules of any international nation, he “shall so proclaim” this. US source of revenue tax charges at the electorate or companies of that nation are then routinely doubled.

Segment 891 of america tax code lets in the president to double US taxes on international electorate and firms – below sure instances.

Yuri Gripas/Pool/EPA

The additional tax which may be amassed is capped at 80% of america taxable source of revenue of the taxpayer. The president can revoke a proclamation, if the international nation reverses its “discriminatory or extraterritorial” taxation.

Segment 891 is an atypical provision – nevertheless it hasn’t ever been implemented. So far as I do know, no different nation has legislated the sort of rule. Importantly, it could simplest observe to an individual or trade matter to source of revenue taxation by means of america.

Take, as an example, a international nationwide incomes a salary in america. If this particular person’s house nation changed into matter to a proclamation below Segment 891, their particular person tax charge in america could be doubled – to up to 74%.

A international corporate incomes taxable income in america would face a doubling of the corporate tax charge from 21% to 42%.

Somewhat of historical past

A model of Segment 891 has been in america tax code since 1934, an previous time of tax disputes and financial melancholy.

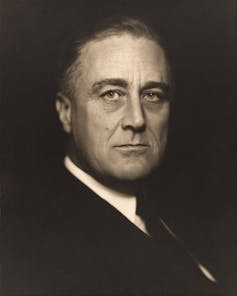

It was once signed into legislation by means of Democratic President Franklin D. Roosevelt on Might 10 1934, amid a tax dispute between america and France.

US President Franklin D. Roosevelt signed Segment 891 into legislation in 1934, placing force on France to finish a tax dispute.

Vincenzo Laviosa/Wikimedia Commons

In line with US tax historian Joseph Thorndike, the transfer adopted makes an attempt by means of France to levy further taxes on US corporations running there, starting within the mid-Twenties.

France had attempted to make use of an 1873 legislation to tax US corporations running in France on income earned within the mum or dad corporate again in america, and in different subsidiaries world wide, no longer simply the French corporate income.

The purpose was once to counter world profit-shifting, which may well be used to cut back the tax payable by means of US subsidiaries running in France by means of claiming deductions or moving source of revenue to different team corporations outdoor France.

The dispute was once long-standing and France attempted to evaluate taxes going again a long time for some US corporations. The possibly huge tax invoice (it sort of feels the tax was once by no means in truth amassed) changed into a geopolitical factor, and the corporations requested america govt to interfere on their behalf.

Thorndike explains {that a} bilateral tax treaty was once negotiated between america and France to treatment this “double tax” state of affairs. However the French legislature refused to ratify it.

In retaliation, US Congress handed Segment 891, and 6 months later, France ratified its bilateral tax treaty with america.

Parallels with these days

In 1934, there have been no virtual multinational enterprises like Meta or Google. However that tax dispute nonetheless has parallels with trendy considerations about taxing corporations across the world.

The French govt was once attempting, with a fairly heavy hand, to counter world profit-shifting by means of huge US multinationals.

Segment 891 was once re-enacted in later US tax codes, as much as these days, with minor amendments and no try to invoke it. It has remained within the background as a possible workout of US fiscal and marketplace energy, supported by means of each side of US politics.

Tax professor Itai Grinberg, who labored within the Biden management at the OECD tax deal, urged it may well be implemented to the Eu Union choice that taxes Apple in Eire.

The United States tech giants are simplest the most recent in a protracted line of tough American multinational companies.

Tada Photographs/Shutterstock

What would possibly Trump do?

President Trump has particularly centered the OECD international tax negotiations with this risk, only a month after Australia has legislated the worldwide minimal tax below “Pillar Two” of the OECD International Tax Deal.

The OECD deal targets to verify huge multinational enterprises pay a minimal 15% efficient tax charge in the entire jurisdictions during which they perform, by means of making use of a top-up tax and under-taxed cash in tax.

Trump asserted in a memorandum that the OECD International Tax Deal is “extraterritorial”, teaching america Secretary of the Treasury and america Industry Consultant to research it.

May Australia be singled out?

Trump’s memorandum additionally ordered an investigation into “other discriminatory foreign tax practices” that can hurt US corporations.

This contains whether or not any international nations aren’t complying with their US tax treaties or have, or are prone to installed position, any tax laws that “disproportionately affect American companies”.

Segment 891 may just observe to such taxes in the event that they had been discovered by means of Trump to be “discriminatory” in opposition to US corporations. What “discriminatory” approach isn’t transparent.

Its been urged that international electorate or corporations may well be secure from Segment 891 by means of their nation’s tax treaty with america, below the usual manner {that a} later treaty prevails over an older code segment. However Australia’s tax treaty with america took impact in 1983, sooner than the latest re-enactment of Segment 891 in america tax code.