On Donald Trump’s go back to the White Area, he issued an government order banning a US “digital dollar”. A compelling new guide, framed as a take-heed call to Western policy-makers, unearths the worldwide importance of this transfer.

It warns the West’s gradual embody of virtual forex frameworks may erode its long-term monetary affect – and diminish its skill to form world financial laws.

Good Cash positions central financial institution virtual currencies (or, CBDCs) as the newest battleground in a brand new Chilly Struggle. CBDCs are virtual cash issued through a central financial institution, sponsored (similar to money) through the federal government of the country issuing it. Whilst america greenback, the UK’s pound and the euro lately don’t have any virtual similar, China has made speedy developments in its virtual yuan (e-CNY).

Assessment: Good Cash: How Virtual Currencies will Win the New Chilly Struggle – and Why the West Must Act Now – Brunello Rosa with Casey Larsen (writer)

Governments keep watch over their CBDCs within the type of safe virtual code. On this manner, they range from (personal) cryptocurrencies – which Trump favours as a substitute.

Good Cash’s authors, monetary economist Brunello Rosa and strategic communications guide Casey Larsen, examine the upward thrust of CBDCs to that of the web 30 years in the past.

Till ultimate month’s ban on a US virtual greenback, 130 international locations, or 98% of the worldwide financial system, were exploring a CBDC to counterpoint money.

The USA faces partisan resistance, with expenses just like the CBDC Anti-Surveillance State Act looking for to prohibit virtual greenbacks over privateness fears. In the meantime, the Ecu Union and UK are prioritising safeguards similar to pseudonymous transactions, to steadiness innovation with civil liberties.

Australia has no present plans to factor its personal CBDC. However will have to it?

Must Australia undertake its personal virtual greenback? Pictured: Chinese language Premier Li Qiang and Anthony Albanese.

Richard Wainwright/AAP

‘A wake-up call’

For Australia, the stakes are specifically top. As a resource-exporting country with deep business ties to China, it should navigate the rising divide between US-led monetary programs and China’s increasing CBDC networks.

The worldwide financial order has been anchored through america greenback since Global Struggle II. Rosa and Larsen argue it faces an existential risk from China-led business networks amongst World South international locations: together with international locations like Russia and Nigeria, which might be increasingly more aligned with China-centred multi-CBDC networks.

They warn if the West stays preoccupied with dystopian fears of virtual currencies, it dangers ceding world monetary management to China.

Trump’s government order might deepen the divide in virtual forex adoption between america and its allies. If China continues to advance CBDC-based business settlements, Australian exporters may face drive to undertake Beijing’s monetary infrastructure. This could carry considerations about Australia’s financial sovereignty and geopolitical leverage.

The rising affect of China’s monetary infrastructure, specifically thru CBDC-driven networks, creates advanced possible choices for Australia in balancing financial pursuits with its strategic ties to america.

The race for virtual cash is already underway – and Australia can not have the funds for to be left at the back of.

The race for virtual cash is underway.

Shutterstock

CBDCs are other from cryptocurrencies

Cryptocurrencies like Bitcoin are decentralised, which means they’re no longer issued or managed through a government. However CBDCs are state-issued and sponsored. This guarantees their steadiness and makes them more uncomplicated to believe.

CBDCs are designed to serve as along or exchange bodily money. They’re the one virtual legal responsibility of a central financial institution, and symbolise a declare on its reserves. This makes them similar to money.

Good Cash specializes in “money as information”. CBDCs will also be programmed with positive laws or stipulations and combine easily with present monetary programs. Extra severely, they are able to be transmitted and processed over the web, enabling real-time, computerized transactions. The pre-programmed bills and transactions those CBDCs permit can meet the particular wishes in their issuing governments.

At its core, Good Cash argues CBDCs aren’t simply monetary inventions. They’re robust geopolitical tools, in a position to reshaping world business, financial sovereignty and the financial order. Their upward thrust is accelerating de-dollarisation, or the diminished affect of america greenback in world business and financing.

Making monetary sanctions much less efficient?

International locations prone to US sanctions, together with China, are specifically attracted to those CBDC-based agreement networks – as america continues to weaponise its greenback.

Only one manner is thru sanctions that exclude positive international locations from the SWIFT device: they’ve been described as “the nuclear option” of monetary sanctions.

The SWIFT community is utilized by banks to ship and obtain knowledge, similar to cash switch directions – together with cross-border bills.

In 2022, a number of Russian banks (together with its central financial institution) have been excluded from SWIFT over the battle on Ukraine. From 2012 to 2016, nearly all Iranian banks have been delisted, over Iran’s nuclear program.

SWIFT exclusion has supposed efficient isolation from a lot of the worldwide monetary device.

CBDC networks permit international locations to circumvent conventional monetary infrastructure and cut back reliance on america greenback in cross-border business.

A number of Russian banks have been excluded from SWIFT world cost programs over the battle on Ukraine in 2022.

Mikhail Klimentyev/AAP

Virtual cash and the business battle

China’s e-CNY is designed to reshape the worldwide financial order. China’s dependence at the dollar-based monetary device makes it prone to US monetary sanctions.

By means of growing a state-backed virtual forex, China seeks to scale back its reliance on Western-controlled monetary infrastructure, similar to SWIFT – and mitigate dangers that might destabilise its business and financial system.

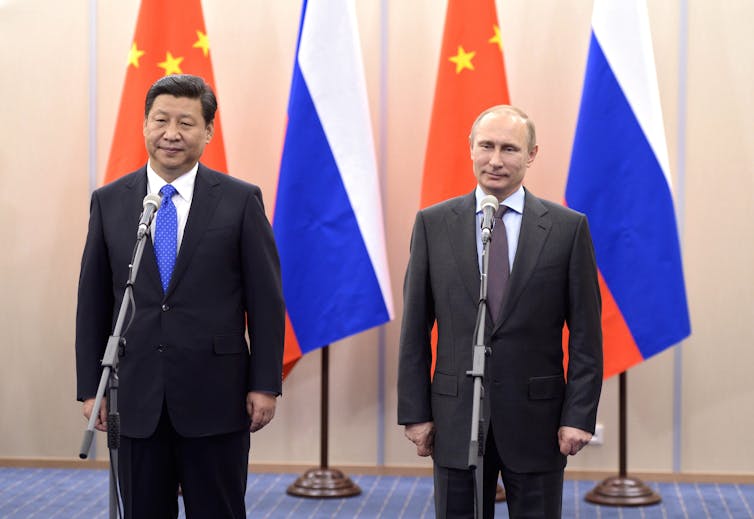

Rosa and Larsen spotlight a pivotal second within the e-CNY’s evolution. On February 4, 2022, all the way through the Beijing Iciness Olympics, Chinese language president Xi Jinping and Russian president Vladimir Putin declared a “partnership of unlimited friendship”.

Quickly after, China’s yuan overtook america greenback as essentially the most extensively used forex for cross-border transactions in Russia. This marked the virtual yuan’s first main alignment with another world monetary device – and signalled an immediate problem to the Western-led financial order.

China’s yuan overtook america greenback for cross-border transactions in Russia after the international locations’ leaders met all the way through the Beijing Iciness Olympics.

Alexei Nikolsky/Ria Novosti/Kremlin Pool/AAP

“The race for digital money,” the authors word, “is intertwined with the race to exploit natural resources”. China objectives to combine the e-CNY into business involving strategic sources: specifically power, meals and demanding minerals.

By means of providing a substitute for dollar-based monetary programs, China demanding situations US financial dominance, whilst tightening keep watch over over business routes and demanding commodities.

A contemporary record from the Asia Society helps the authors’ arguments. It suggests a possible transfer from a (petrodollar device – the place US greenbacks are paid to oil-producing international locations for his or her exports – to a virtual framework for vital sources ruled through the Chinese language yuan. China dominates all these provide chains, which might be crucial for complex applied sciences and defence.

Virtual forex as strategic weapon

Rosa and Larsen argue Beijing objectives to transform “the chief architect of all trade conducted in state-issued digital currencies”. First, through organising the important bodily and virtual infrastructure. Then, through atmosphere the technological requirements and laws.

Their guide examines how Beijing is integrating the virtual yuan into the Belt and Street Initiative (BRI), an infinite community of construction and funding tasks around the globe, linking China to different international locations thru bodily and virtual infrastructure. That is increasing China’s monetary affect over strategic business routes and markets, such because the China–Pakistan Financial Hall and the Silk Street Financial Belt in Kazakhstan.

Egypt’s development of its new administrative and monetary capital is being finished in a partnership aligned with China s Belt and Street Initiative.

KHALED ELFIQI/AAP

The worldwide shift clear of america greenback (“De-Dollarization 2.0”) has sped up since 2022. The authors examine its importance to the post-1944 upward thrust of the Bretton Woods device, which used the gold usual to create a set forex trade charge – and to the Seventies established order of the petrodollar.

How do multi-CBDC platforms supply rising economies with a substitute for Western-dominated monetary programs? They streamline business and cut back reliance on conventional monetary infrastructure and reserve currencies (like america greenback, euro, and British pound).

As extra international locations discover virtual choices, the possible to circumvent Western-led regulatory regimes will increase.

Pakistani Military patrol on a highway as safety has been intensified all the way through the consult with of Chinese language Vice High Minister He Lifeng to wait the th anniversary celebrations of the China Pakistan Financial Hall CPEC in Islamabad Pakistan.

OHAIL SHAHZAD/AAP

Two international financial blocs

This shift is dividing the arena into two financial blocs. One is the G7, which is composed of america, Canada, France, Germany, Italy, Japan and the UK (UK). The opposite is the World South: international locations in Africa, Latin The us, Asia and Oceania which are in most cases characterized through decrease source of revenue ranges and rising economies. Those international locations frequently face demanding situations associated with construction and world inequality.

The G7 is likely one of the international’s primary financial blocs. Right here, its leaders acquire in Italy, in 2024.

Ciro Fusco/AAP

BRICS – in most cases thought to be a vital a part of the World South – at first consisted of Brazil, Russia, India, China, and South Africa. In recent times, the bloc has expanded to incorporate international locations like Egypt, Ethiopia, Iran, the United Arab Emirates (UAE), and maximum just lately, Indonesia – strengthening its geopolitical and financial affect.

Whilst the G7’s percentage of worldwide GDP declines, BRICS+ international locations are leveraging their demographic, financial and useful resource energy to counterbalance the West.

BRICS is an increasing world frame, thought to be a vital a part of the World South. It accrued in Russia in 2024.

Maxim Shemetov/Pool Photograph/AAP

On the similar time, Iran and different states aligned to China’s Belt and Street Initiative are deepening their monetary ties with China, to scale back dependence on Western-controlled financial programs.

Rosa and Larsen argue Trump’s protectionist insurance policies – relatively than curtailing China’s upward thrust – have inadvertently driven extra international locations towards financial alignment with Beijing and clear of america greenback.

Is the West dropping the sensible cash race?

In areas with underdeveloped banking infrastructure, like Nigeria (which has the eNaira) and The Bahamas (with its Sand Greenback), CBDCs be offering a possibility to circumvent conventional banking. They supply speedy, reasonably priced monetary inclusion and world transactions.

However, Western scepticism of CBDCs is rising. It’s pushed through fears of presidency overreach and the possible misuse of programmable cash: for geopolitical keep watch over, or transaction restrictions in accordance with location or time.

CBDCs be offering a possibility to circumvent conventional banking in international locations with underdeveloped banking infrastructure, like The Bahamas.

shutterstock

Those considerations stem from the two-tiered construction of sensible cash. CBDCs leverage decentralised applied sciences, like blockchain, for transactions. However their governance, construction and insurance policies stay firmly underneath state keep watch over.

Rosa and Larsen argue this centralised oversight grants governments who use CBDCs exceptional authority over monetary task, together with real-time acquire tracking, transaction limits and spending restrictions.

China exemplifies this style. Its CBDC infrastructure prioritises programmability and state keep watch over.

The virtual yuan is built-in into China’s social credit score device, reinforcing state oversight thru surveillance networks like Skynet. Skynet is a extremely refined device that tracks folks’ movements, assigning social credit score rankings in accordance with their actions. (Monetary habits, adherence to rules, or even social and ethical habits are incorporated.)

The e-CNY complements its effectiveness through offering real-time information on monetary transactions, making it more uncomplicated for the federal government to watch and assessment electorate’ monetary behaviours.

An pressing caution Australia will have to heed

Good Cash argues CBDC construction is a strategic necessity, no longer simply monetary innovation. It’s an pressing caution.

The guide’s biggest energy lies in its skill to synthesise advanced geopolitical and monetary developments right into a cohesive narrative. The authors’ parallels between the upward thrust of CBDCs and the web bolster their argument that “digital currencies are not just upgrades, but foundational shifts in how value and power circulate globally”. It’s convincing.

Alternatively, Good Cash’s alarmist tone occasionally overshadows a extra nuanced dialogue. The authors downplay demanding situations to China’s ambitions, together with world scepticism in regards to the yuan’s convertibility, and the entrenched inertia of dollar-based business.

Their critique of US complacency occasionally paints non-Western tasks as monolithic threats, overlooking regional nuances just like the unbiased ambitions of the United Arab Emirates’ in monetary generation.

Regardless of those caveats, the guide provides a pointy and insightful exam of the geopolitical and monetary stakes of CBDCs.

Even a modest world shift in opposition to virtual currencies may erode call for for america greenback, weakening its borrowing energy. This could make Western markets, together with Australia, extra unstable.

As a resource-driven financial system deeply intertwined with China, Australia should urgently reconsider its monetary and financial methods in accordance with those moving dynamics.