US price lists – each threatened and imposed – on business companions together with China, Canada, Mexico and the EU temporarily activate waves of retaliatory measures. The most recent commodities within the points of interest of president Donald Trump are metal and aluminium – with price lists of 25% introduced for all imports. However no longer best do those taxes disrupt well-established business flows, they ignite considerations over the very long term of globalisation.

But amid this uncertainty, it’s imaginable that there could also be a silver lining. Trump would possibly inadvertently be paving the best way for a realignment of business relationships and the emergence of recent financial blocs. Such partnerships may foster extra resilient and domestically centered financial cooperation.

Trump’s choice to levy price lists on its main buying and selling companions disrupts the basic tenets of the gravity type of business. In line with this concept, business between two international locations is in large part made up our minds by means of their financial dimension and proximity. As an example, introducing price lists to the shut financial courting between the USA and Canada, underpinned by means of their shared border, successfully will increase the gap between the 2 by means of elevating prices and lowering the quantity of bilateral business.

On the other hand, those disruptions can inadvertently inspire diversification of business relationships. As corporations and governments search to mitigate the hazards related to price lists, they will start to discover new markets and choice provide chains. This may in the end result in a extra dispersed and – doubtlessly – extra strong international business device.

But as Trump continues to check the boundaries of his energy, he’s studying it isn’t really easy to defy gravity. Already, the president has dialled down price lists on Canada and Mexico, whilst China has struck again with retaliatory measures.

One sure spin-off of the business struggle could also be the reinforcement of regional alliances. With conventional business flows disrupted, nations are more and more incentivised to toughen ties with neighbouring economies.

North American outlook

Canada and Mexico, lengthy thought to be herbal buying and selling companions of the USA, would possibly pivot against deepening their financial cooperation. They might also glance to bilateral agreements with different companions in addition to in quest of new markets, strengthening ties with China and Japan.

The USMCA (United States-Mexico-Canada Settlement) supplies a powerful basis for business. However makes an attempt to dismantle this association may see Canada and Mexico accelerating efforts to construct nearer financial ties with different areas, lowering their publicity to the USA marketplace.

Trump unearths his plans for sweeping metal price lists on “everybody”.

Trump’s deliberate price lists on metal threaten to undermine the USMCA. Finally, it’s designed to foster built-in provide chains and low-tariff financial cooperation a few of the 3 nations. That is more likely to escalate business tensions around the bloc, forcing a reassessment of the business settlement’s key phrases and destabilising the established relationships.

Eu Union outlook

The imposition of price lists at the EU may result in deepening integration amongst its member states. Confronted with new pressures from the USA, the EU would possibly boost up projects aimed toward consolidating interior business, harmonising rules and selling intra-Eu provide chains.

Member states, with France at the vanguard, are already advocating for a united reaction to counteract US protectionism. They hope to sign a powerful political dedication to withstand the pressures from Trump.

Asia-Pacific outlook

China, as the arena’s second-largest economic system in the back of the USA, would possibly search to increase its business relationships within the Asia-Pacific area and past. As China’s financial enlargement type is export-led, it’ll search more potent partnerships with regional gamers and put money into new business agreements. This may doubtlessly give upward push to an much more built-in Asian financial group.

A brand new financial order

No matter else performs out, those tariff wars sign a reordering of the worldwide financial panorama. Such disruptions, despite the fact that painful within the brief time period, can create long-term adjustments that rebalance financial techniques. The herbal buying and selling spouse speculation reinforces this view by means of highlighting how nations with shared cultural, historic and geographical ties are more likely to deepen their financial relationships within the face of exterior shocks.

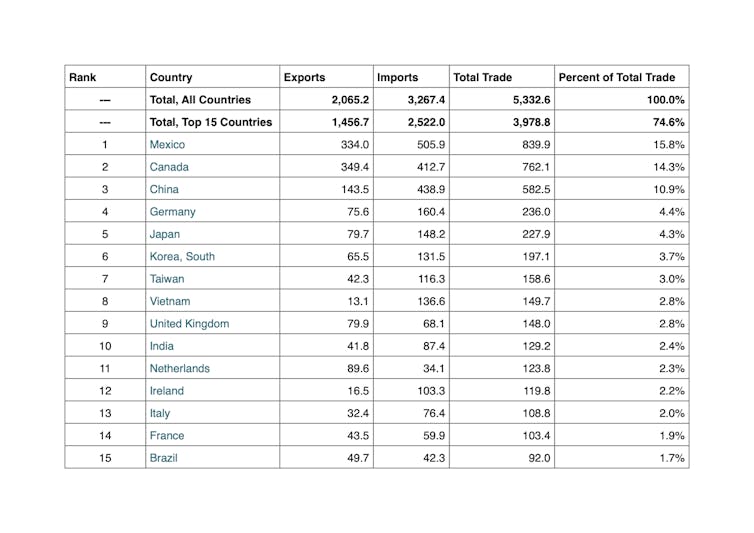

Desk of US business

Supply: US Bureau of Financial Research (2025)

Creator equipped

On this new order, conventional superpowers would possibly in finding themselves challenged by means of unified responses from different international locations. Via implementing price lists, the USA dangers setting apart itself from those rising alliances, whilst its main buying and selling companions would possibly turn out to be united of their efforts to counterbalance emerging American protectionism.

The ripple results of the USA tariff row prolong well past the immediately concerned nations, with vital implications for international business networks. For the United Kingdom, already dealing with the aftermath of Brexit, this new setting provides each demanding situations and alternatives.

With US-led protectionism disrupting conventional business channels, the United Kingdom may clutch the chance to diversify its export markets by means of forging more potent ties with the EU and digging deeper into its Commonwealth alliances. It will make stronger its place as a hub for global trade whilst proceeding to domesticate its courting with the USA. Managing Trump is a gentle balancing act for high minister Keir Starmer, as each are anticipated to be in administrative center for 4 years.

A phrase of warning – negotiating global business agreements is a posh and long procedure. That is the laborious lesson discovered by means of the United Kingdom. Its business with the EU (its maximum essential business spouse) shrank after Brexit, using the hunt for brand new buying and selling companions and agreements. However those end result are sluggish to materialise.

The United Kingdom officially asked accession to the Complete and Revolutionary Settlement for Trans-Pacific Partnership (CPTPP) in February 2021, however best signed the accession protocol in July 2023.

And we will have to no longer disregard that during 2024 the United Kingdom halted its business talks with Canada after two years of negotiations, because of disagreements over the criteria on some agricultural merchandise.

Price lists include demanding situations, however they may also be the start of a sluggish and painful trade against a extra balanced and strong international financial order.