U.S. President Donald Trump has agreed to pause his deliberate price lists on Canada and Mexico for a minimum of 30 days following talks with the leaders of each nations. Up to now, a senior Canadian governmental professional had mentioned Trump’s 25 in keeping with cent tariff on maximum Canadian items used to be anticipated to return into impact on Feb. 4.

If carried out, this tariff may have vital financial penalties on either side of the border, because the U.S. and Canada proportion one of the vital biggest bilateral industry relationships on the earth.

A key worry is the extremely built-in provide chains between the 2 nations. Many items go the border more than one instances as intermediate inputs earlier than changing into ultimate merchandise. Enforcing price lists at any level on this provide chain will carry manufacturing prices and build up costs for a variety of items traded between the U.S. and Canada.

For Canada, the price lists on Canadian merchandise will considerably impact Canada’s competitiveness within the U.S. marketplace by means of riding up costs. Such price lists may pose severe demanding situations for quite a lot of sectors in Canada, given the rustic’s heavy reliance at the U.S. economic system.

Results on other sectors

The affect of U.S. price lists on Canadian costs is prone to vary throughout sectors and merchandise, relying on their reliance at the U.S. marketplace.

Sectors with the next dependence on U.S. industry are prone to revel in extra serious disruptions. If the price lists make sure merchandise uncompetitive, Canadian manufacturers might fight to protected selection markets within the brief time period.

Industries akin to agriculture, production and effort will revel in various levels of affect. Power merchandise and motor automobiles, which constitute Canada’s biggest exports to the U.S., are anticipated to be a few of the maximum adversely affected.

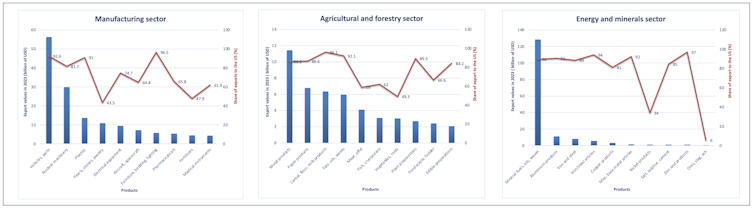

Canada’s exports of various merchandise to the U.S. within the production, agriculture and effort sectors.

(Global Built-in Industry Answer)

Within the agricultural and forestry sector, picket and paper merchandise, at the side of cereals, are amongst Canada’s biggest exports to the U.S., with the U.S. accounting for 86 to 96 in keeping with cent of those exports, in line with information from the Global Built-in Industry Answer.

Within the power and mineral sector, crude oil is Canada’s most sensible export, achieving US$143 billion in 2023, with 90 in keeping with cent destined for the U.S. Given its crucial function as Canada’s biggest export throughout all sectors, it isn’t sudden that Trump has famous crude oil can be matter to a decrease tariff of 10 in keeping with cent.

Canada’s dependence on U.S. industry

When inspecting the affect on other merchandise, it’s no longer simplest the price of industry that issues, but additionally the percentage of industry. The proportion of industry signifies how reliant Canada is at the U.S. in comparison to different markets.

A prime industry proportion with the U.S. suggests a product is especially susceptible to industry disruptions, as Canada relies closely at the U.S. marketplace for that product. Conversely, a decrease proportion signifies that Canada has diverse providers, which reduces its dependence at the U.S.

For example, in 2023, Canada’s most sensible exports to the U.S. incorporated automobiles and portions, nuclear equipment and plastics, in line with information from the Global Built-in Industry Answer. The U.S. accounted for 93 in keeping with cent of car and portions exports, 82 in keeping with cent of nuclear equipment exports, and 91 in keeping with cent of plastics exports.

This knowledge highlights Canada’s excessive dependence at the U.S. marketplace, making those industries inside the production sector extremely vulnerable to the tariff. This may hurt jobs within the production sector, which is essential to employment in Canada, offering jobs for over 1.8 million other folks.

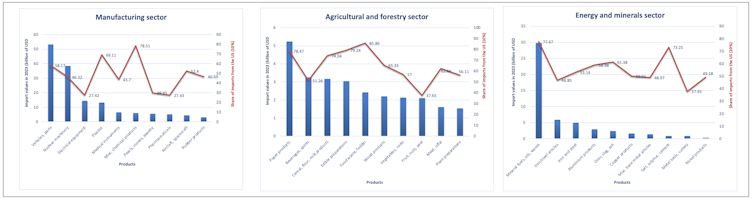

Canada’s reliance at the U.S. could also be obtrusive in imports. In 2023, automobile imports totalled US$92 billion, with the U.S. accounting for 58 in keeping with cent of that quantity.

Canada’s imports of various merchandise from the U.S. within the production, agriculture and effort sectors.

(Global Built-in Industry Answer)

The dependence could also be obtrusive within the agri-food and forestry sector, the place Canada closely is determined by U.S. imports. This implies that retaliatory price lists on agricultural items from the U.S. can have a considerable affect on meals costs in Canada.

Retaliatory price lists and inflationary pressures

Canada has introduced it’s enforcing $155 billion of retaliatory price lists on U.S. imports in reaction. This may give a contribution to inflationary pressures inside Canada.

Top Minister Justin Trudeau says this contains instant price lists on $30 billion value of products as of Tuesday, adopted by means of additional price lists on $125 billion value of American merchandise in 21 days’ time to “allow Canadian companies and supply chains to seek to find alternatives.”

This may occasionally come with price lists on “everyday items such as American beer, wine and bourbon, fruits and fruit juices, including orange juice, along with vegetables, perfume, clothing and shoes,” and in addition on main shopper merchandise like family home equipment, furnishings and sports activities apparatus, and fabrics like lumber and plastics.

Given Canada’s vital dependence on U.S. imports, the retaliatory price lists will carry the price of American items coming into the rustic, additional riding up shopper costs and exacerbating inflation.

In its newest coverage fee announcement, the Financial institution of Canada warned of the serious financial penalties of Trump’s price lists, highlighting their doable to opposite the present downward development in inflation.

Top Minister Justin Trudeau delivers remarks at a Canada-US family members assembly on the Ontario Funding and Industry Centre in Toronto on Jan. 31, 2025.

THE CANADIAN PRESS/Chris Younger

What will have to Canada do now?

Canada will have to lengthen its financial international relations efforts past the Trump management, enticing with the U.S. Congress and Senate to suggest for the reconsideration of price lists on Canadian items. The Canadian govt will have to persist in leveraging this channel to push for a reversal of the price lists. This sort of broader negotiation stays among the finest method to mitigating industry tensions and making sure solid financial family members with the U.S.

On the similar time, Canada will have to cut back dependence at the U.S. marketplace by means of adopting a complete export diversification technique. Whilst the U.S. stays a handy and obtainable industry spouse, increasing into rising and growing markets would assist mitigate dangers and create extra solid long-term industry alternatives.

One efficient means to reach export diversification is by means of increasing loose industry agreements (FTAs) with rising and growing economies. These days, Canada has 15 FTAs overlaying about 51 nations, however there’s room for growth. On the other hand, signing FTAs by myself is inadequate; Canada will have to be sure that those agreements translate into tangible industry enlargement with spouse nations.

World politics is more and more shaping world industry, making it crucial for Canada to proactively organize diplomatic and industry family members. Lately, tensions have emerged with key companions akin to China, India and Saudi Arabia. Those nations may all transform doable markets for Canadian merchandise. For the reason that China is Canada’s second-largest export vacation spot, there’s vital doable to increase industry ties.

Moreover, nations just like the United Arab Emirates provide promising markets, specifically for agricultural merchandise, because the UAE imports about 90 in keeping with cent of its meals.

U.S. President Donald Trump solutions questions from journalists as he indicators an government orders within the Oval Workplace of the White Space on Jan. 23, 2025 in Washington.

(AP Picture/Ben Curtis)

Boosting innovation and productiveness

Canada stands at a crucial juncture in its industry dating with the U.S. Whilst diplomatic efforts stay crucial to heading off destructive price lists, they can’t be the rustic’s simplest line of defence.

Boosting productiveness is without doubt one of the best tactics for Canada to reinforce its competitiveness in world markets. Canadian manufacturers will have to prioritize innovation and the adoption of complicated applied sciences to give a boost to potency and care for a aggressive edge, specifically as they search to increase past the U.S.

In keeping with doable U.S. price lists, the Canadian govt will have to put in force a bailout technique to offer temporary reduction and mitigate earnings losses to corporations that can be most commonly affected. Moreover, Canada will have to leverage its embassies and consulates international to advertise exports and assist affected corporations establish and get entry to new marketplace alternatives.

Through doing this, Canada can place itself as a extra self-reliant and aggressive participant within the world economic system — one much less susceptible to transferring U.S. insurance policies.