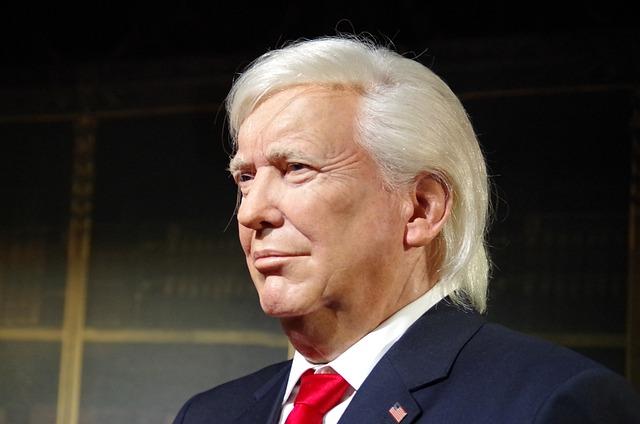

House GOP Tax Proposal: A Reflection of Trump’s Vision with Notable Omissions

In a pivotal development in fiscal policy, the House Republican Party has put forward a tax reform bill that closely mirrors former President Donald Trump’s enduring aspirations for tax changes. This legislation aims to transform the financial framework for both individuals and businesses, promising streamlined tax rates and the removal of various deductions. While it seeks to fulfill many economic commitments made during Trump’s presidency, certain aspects have been excluded due to party dynamics and fiscal conservatism. As discussions commence, the ramifications of this proposed overhaul could reverberate throughout the economy, affecting taxpayers and enterprises nationwide. This article will analyze key features of the bill, identify significant omissions that may impede Trump’s objectives, and assess potential outcomes for both the GOP and American citizens.

GOP Tax Bill Reflects Trump’s Economic Agenda but Leaves Gaps

The recently introduced House GOP tax proposal largely embodies priorities advocated by former President Trump, aiming to achieve several long-held economic goals. Among its main features are substantial reductions in corporate taxation alongside modifications to individual income brackets—both aligning with Trump’s vision for stimulating economic growth through lower taxes. The proposal notably emphasizes permanent cuts in taxation rates aimed at corporations and high-income earners, reflecting a commitment to supply-side economics that has defined Republican policies under Trump’s leadership.

However, despite capturing many elements from Trump’s agenda, this bill lacks critical components that could undermine its overall effectiveness. One glaring omission is any strategy addressing pressing fiscal challenges related to national debt; critics are raising concerns about whether such tax reductions can be sustained over time. Furthermore, there is insufficient focus on providing tax relief specifically targeted at middle-income families—a move that risks alienating an essential voter demographic.

The absence of comprehensive plans for necessary reforms within popular programs like Social Security and Medicare also raises alarms regarding potential long-term effects on discretionary spending levels. As stakeholders scrutinize these details further, success hinges on balancing immediate tax relief against responsible fiscal management.

Need for Fiscal Impact Analysis of Tax Proposals

This House GOP tax initiative prompts vital inquiries concerning its fiscal repercussions. An exhaustive analysis is crucial to evaluate how these proposed changes might influence federal deficits as well as overall economic stability moving forward. Various stakeholders are advocating for transparent assessments so they can better understand how reduced taxation rates coupled with new deductions will affect job creation prospects and government revenue reliability.

Certain areas warrant close examination:

- Tax Rate Reductions: What will be their effect on long-term federal income?

- Deductions Introduced: How might these adjustments impact middle- or low-income households?

- Corporate Tax Modifications: Are anticipated benefits realistic over time?

| Tax Measure | Plausible Outcome |

|---|---|

| Cuts in Corporate Tax Rates | Possible rise in corporate investments |

| Affecting Capital Gains Taxes | Pushed investments among affluent individuals |

Democratic Strategies to Challenge Republican Tax Plans Effectively

The recent introduction of a House GOP tax bill closely aligned with former President Trump’s agenda necessitates an assertive response from Democrats aimed at counteracting these proposals effectively. By highlighting disparities within this legislation’s provisions—particularly those detrimental impacts on middle-class families—they can draw attention away from perceived benefits favoring corporations or wealthy individuals.

Key strategies include:

- Shed Light on Inequities: Illustrate how proposed alterations disproportionately advantage large corporations while disadvantaging average taxpayers.

- Pursue Middle-Class Relief Initiatives: Propose alternative measures designed explicitly around supporting middle-class citizens’ financial well-being.

- Aim To Fortify Social Safety Nets: Advocate enhancements targeting social programs essential for low- or moderate-income households as counterbalances against cuts elsewhere.

Additionally, it remains imperative for Democrats to convey their vision clearly across platforms. Utilizing social media channels along with town hall meetings allows them direct engagement opportunities fostering constituent support.

| Strategy | Description |

|---|---|

| Consistent Messaging | Ensure all party members articulate unified messages resonating deeply within constituents’ concerns .< / td > |

Final Thoughts h2 >

In summary ,the newly presented House GOP tax proposal signifies considerable alignment with former President Donald Trump ’ s priorities encapsulating numerous facets his desired fiscal agenda . Nevertheless , notable exclusions dissenting opinions within party underscore complexities challenges persisting legislative process . As lawmakers navigate intricacies surrounding reform efforts , forthcoming weeks will determine whether this measure garners sufficient bipartisan backing advance through Congress . With critical negotiations ahead , outcome not only shapes future landscape but also influences political dynamics leading into 2024 elections .