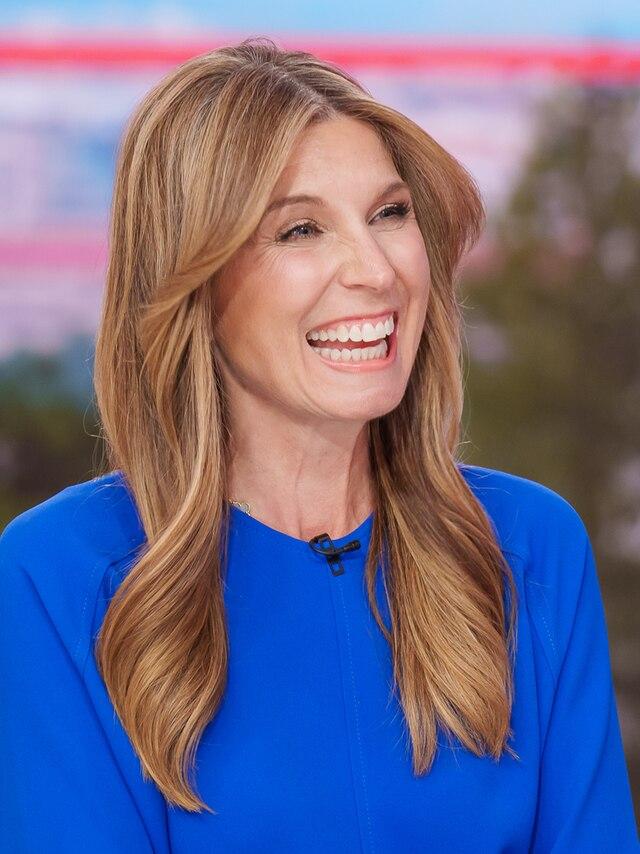

In a recent segment on MSNBC, Nicolle Wallace analyzed the complex relationship between Federal Reserve Chair Jerome Powell and former President Donald Trump, highlighting the nuanced dynamics that characterize their interactions. Wallace asserted that Powell’s tenure at the helm of the Federal Reserve has been marked by a unique resilience, particularly in the face of Trump’s attempts to exert political influence over monetary policy. As the economy grapples with inflation and fluctuating markets, Wallace’s commentary delves into the implications of Powell’s steadfastness, positing that he has successfully navigated the political pressures exerted by the former president without compromising the integrity of his role. This examination not only sheds light on the challenges faced by key economic leaders but also raises questions about the intersection of politics and financial governance in a nation still reckoning with the remnants of Trump’s administration.

Nicolle Wallace Analyzes the Dynamics Between Jerome Powell and Donald Trump

Nicolle Wallace offered a compelling analysis of the complex relationship between Jerome Powell, the Chair of the Federal Reserve, and former President Donald Trump during a recent segment on MSNBC. She highlighted how Powell navigated the turbulent waters of Trump’s economic policies and public criticisms without succumbing to pressure—or humiliation. This dynamic, Wallace explained, reflects a broader narrative about the autonomy of financial institutions amid political interference. Most notably, she emphasized how Powell’s decisions were rooted in economic principles rather than political expediency, which is increasingly vital in today’s polarized environment.

Wallace pointed out several key aspects of their interactions that underscore Powell’s resilience and independence:

- Independence of the Federal Reserve: Powells’s steadfast commitment to the Fed’s long-standing principles, even in the face of Trump’s public outbursts.

- Economic Data Over Politics: Powell’s decisions, driven by economic indicators, showcased his priority for the nation’s financial health over political favor.

- Response to Pressure: His ability to remain composed and focused on monetary policy, despite numerous attempts by Trump to influence rate changes.

| Key Interaction | Outcome |

|---|---|

| Trump’s Criticism of Rate Hikes | Powell maintained rates, unaffected by pressure. |

| Public Attacks on Fed Policy | Displayed resilience, focusing on data-driven decisions. |

| Calls for Lowering Interest Rates | Prioritized economic stability over political gain. |

The Implications of Powell’s Independence on Federal Reserve Policy

As Jerome Powell continues to navigate the complex waters of U.S. monetary policy, his independence from political pressures—especially notable during Donald Trump’s presidency—has significant ramifications for the Federal Reserve’s overarching strategy. A central component of Powell’s stewardship has been his commitment to prioritizing economic data over partisan influence, allowing for decisions that reflect the broader interests of the economy rather than any one individual’s agenda. This approach not only strengthens the credibility of the Federal Reserve but also underpins its role as an institution tasked with maintaining stability in an unpredictable financial landscape.

Moreover, the implications of Powell’s independence are multifaceted, influencing both market perceptions and the Fed’s long-term strategies. Key consequences include:

- Increased Market Confidence: Investors show a greater willingness to engage with monetary policy when they believe decisions are insulated from political maneuvering.

- Consistency in Policy Making: A unified approach under Powell can lead to a more predictable economic climate, which is essential for long-term planning by businesses and consumers.

- Focus on Inflation Control: Powell’s resistance to external pressures facilitates a stronger focus on controlling inflation, providing the Fed with the latitude to raise interest rates if necessary.

In this context, Powell’s leadership suggests a cautious yet assertive stance in monetary policy, which could redefine the relationship between the Federal Reserve and the political arena. While the future remains uncertain, Powell’s ability to maintain his independence will be pivotal in shaping how the Fed addresses upcoming economic challenges, including volatile markets and inflationary pressures.

Understanding the Consequences of Political Pressure on Economic Leadership

The dynamics between political figures and economic leaders often hold significant implications for broader financial markets and overall economic stability. In the case of Jerome Powell, the Federal Reserve Chair, his ability to withstand pressure from former President Donald Trump exemplifies how governance can directly influence monetary policy. Powell faced relentless scrutiny and public criticism from Trump, particularly regarding interest rate decisions that are pivotal for economic growth. This scenario raises critical questions about the autonomy of central banks and the potential repercussions of political interference. When leaders like Powell refrain from yielding to political demands, they not only protect institutional integrity but also influence investor confidence and market stability.

Furthermore, the interaction between political and economic entities impacts various stakeholders, highlighting the complexity of leadership under pressure. Consider the following factors that come into play:

- Market Reactions: Changes in Fed policies can lead to immediate market fluctuations based on investor expectations.

- Public Trust: Maintaining independence bolsters trust in institutional frameworks and the efficacy of economic policies.

- Inflation Control: Political pressures can jeopardize efforts to manage inflation, potentially leading to long-term economic challenges.

Understanding these consequences emphasizes the importance of securing the independence of economic leaders, as their decisions ultimately influence the financial landscape on a grand scale. A balanced approach, where economic leaders operate without political intervention, could foster a healthier economic environment conducive to growth and stability.

Key Takeaways

In conclusion, Nicolle Wallace’s analysis of Federal Reserve Chair Jerome Powell’s tenure sheds light on the intricate relationship between economic policymaking and political influence. By examining Powell’s resilience against the pressures exerted by former President Donald Trump, Wallace underscores the critical role of independence within the Federal Reserve. As Powell navigates the dual challenges of inflation and political scrutiny, his actions will remain closely watched by analysts and the public alike. The implications of his decisions could have far-reaching consequences for both the U.S. economy and the broader political landscape, reinforcing the enduring need for autonomy in key economic institutions. As the dialogue surrounding fiscal policy continues to evolve, the significance of Powell’s leadership will undoubtedly remain a central theme in discussions about the future of American economic governance.