Senate’s Commitment to Tax Reform: A Critical Step Forward

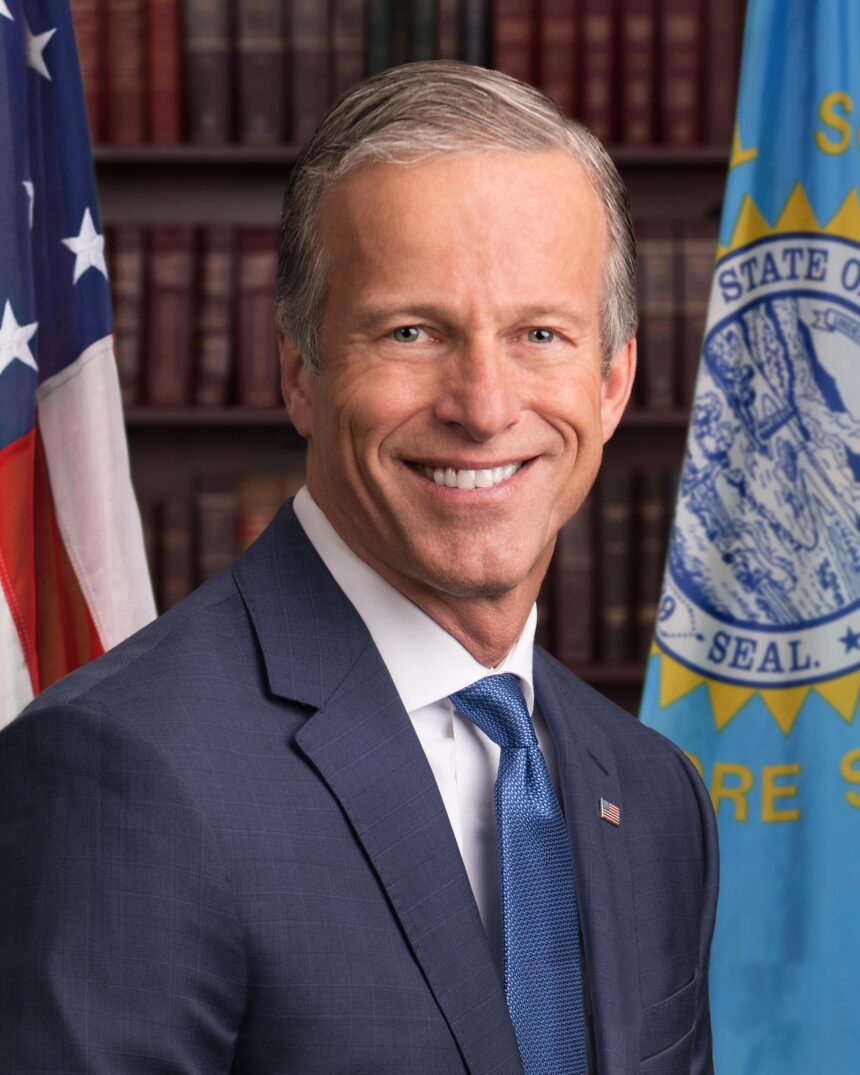

In a strategic decision aimed at propelling essential economic initiatives, Senate Republican Leader John Thune declared that the Senate will remain in Washington, D.C. until a thorough tax reform package is approved. This declaration underscores the urgency lawmakers are placing on tax reform as discussions heat up during the concluding phase of the legislative session. With an increasing number of business leaders and constituents calling for substantial tax relief, Congress faces significant pressure to produce a plan that meets the urgent demands of the economy. As deliberations progress, attention will be focused on whether bipartisan agreement can be reached before lawmakers depart for their holiday recess.

Thune Highlights Importance of Tax Reform as Senate Extends Session

In remarks that have garnered considerable attention from both legislators and citizens alike, Senator John Thune emphasized the pressing need to accelerate the approval process for the proposed tax reform package. Frustration is growing as negotiations continue without resolution; Thune has made it clear that senators will not adjourn until a vote takes place on this critical legislation. “We cannot afford any more delays—American families and businesses depend on us to provide them with necessary relief,” he stated emphatically. The key elements of this tax proposal include:

- Tax Relief for Middle-Class Families: Designed to alleviate financial pressures faced by working households.

- Business Incentives: Aimed at encouraging investment and fostering job creation.

- Simplification of Tax Code: Streamlining regulations for improved compliance and efficiency.

As developments unfold, Thune’s office has indicated ongoing efforts to engage both parties in order to secure bipartisan support while stressing the time-sensitive nature of this legislation. “This issue transcends mere numbers; it directly affects people’s lives,” he remarked, advocating for swift action. In a recent press briefing, he also pointed out potential economic advantages expected from this package which could significantly enhance growth in upcoming fiscal periods. Below is an overview table detailing anticipated outcomes from this proposed tax initiative:

| Description | Potential Impact |

|---|---|

| Boosted Disposable Income | A rise in consumer spending levels |

| Create New Jobs | A decrease in unemployment figures |

| A surge in overall economic activity | |

| Feature< / th > | Expected Outcome< / th > < tr /> |

|---|---|

Increase In Standard Deduction< td />

|

|

|

| td >

| < Strong Economic shifts favoring greener alternatives <

/ Strong > td >

| < Strong Small Business Deductions<

/ Strong > td >

| < Strong Strengthened local economies <

/ Strong > td >

|

Strategies For Stakeholders During Ongoing Tax Package Negotiations h2 >

If negotiations regarding taxation packages persist , stakeholders must adopt proactive strategies facilitating dialogue encouraging consensus building . Businesses should clarify how these reforms may impact operations workforce engaging directly with lawmakers providing insights fostering understanding . Community leaders might stress equitable policies supporting local development ensuring constituent voices represented discussions . Stakeholders encouraged focus collaborative approaches forming coalitions representing diverse interests advocacy groups amplify efforts communicate potential benefits public rally grassroots support analysts economists play pivotal roles presenting data-driven forecasts highlighting long-term implications changes proposed streamline communication efforts utilizing resources such as : p > |