In a surprising turn of events,former President Donald Trump has opted to delay the implementation of higher tariffs on imports,a decision that analysts suggest is largely influenced by recent fluctuations in the U.S. bond market. As investors grapple with rising interest rates and increased volatility, the bond market’s jitters appear to have prompted concerns about the broader economic ramifications of escalating trade tensions. This pause in trump’s tariff strategy could signify a strategic recalibration in response to financial instability, reflecting the intricate interplay between fiscal policy and market confidence. In this article, we will delve into the factors that have led to this unexpected decision and analyze the potential implications for both domestic and international economic landscapes.

Navigating Uncertainty: How US bond Market Fluctuations Influence Tariff Decisions

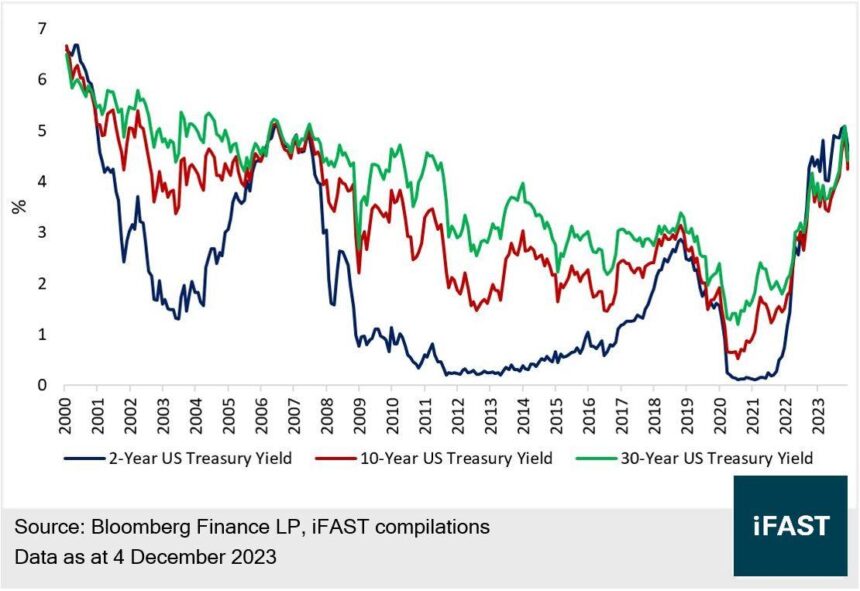

The recent tremors in the US bond market have sent ripples through various economic sectors, with tariff policy being one of the most affected. As bond yields fluctuate, reflecting investors’ expectations of economic stability, the government’s approach to tariffs has begun to pivot in response to these changes. President Trump’s choice to delay the proposed tariff increases manifests a strategic focus on maintaining economic confidence amid uncertainty. Key factors influencing this decision include:

- investor Sentiment: A decrease in bond prices often signals worries about economic growth, prompting policymakers to tread carefully.

- Supply Chain Stability: Higher tariffs could exacerbate existing supply constraints, particularly in industries already impacted by inflationary pressures.

- Global Trade Relations: Fluctuations in the bond market can complicate negotiations with trading partners, making unilateral tariff decisions less favorable.

This delicate balancing act highlights the intricate relationship between capital markets and trade policy. As the bond yields reflect less investor confidence, the potential negative impacts on consumer spending and business investment loom larger in the decision-making process. Recent volatility may compel the administration to refine its tariff strategies, ensuring they align with broader economic indicators. For context, the following table illustrates recent bond yield trends alongside tariff proposals:

| Time Period | 10-Year Bond Yield (%) | Proposed Tariff Increase (%) |

|---|---|---|

| Q2 2023 | 3.50 | 5.0 |

| Q3 2023 | 4.25 | 2.0 |

| Q4 2023 | 3.75 | 0.0 (Paused) |

economic Implications: The Broader Impact of Tariff Delays on Global Trade

The recent postponement of higher tariffs marks a meaningful pivot in U.S. trade policy, with ripple effects that extend well beyond American borders. Analysts suggest that this decision may pacify immediate uncertainties in financial markets,but the broader economic implications could reverberate through global trade networks. With tariffs on key imports being delayed, industries reliant on these goods can continue their operations without the threat of escalating costs, thereby stabilizing supply chains that are still recovering from past disruptions.

Moreover, the postponement could enhance diplomatic relations with trading partners, fostering a more cooperative atmosphere that benefits multilateral agreements. Key impacts include:

- Increased Consumer Confidence: Lowered import costs may translate to reduced prices for consumers, boosting demand in the economy.

- Sustained Business Investments: Companies can plan investments without the unpredictability of tariff hikes, encouraging expansion and innovation.

- International Market Dynamics: Nations will reassess their own trade strategies in light of U.S. tariff policies, potentially reshifting alliances and trade partnerships.

| Sector | Impact of Tariff Delays |

|---|---|

| manufacturing | Stable input costs, preserving jobs |

| Retail | Lower prices, increased consumer spending |

| Technology | Continued supply chain integrity, fostering innovation |

Strategic Recommendations: Mitigating Risks Amidst Market Jitters and Trade Policy Changes

In the current climate of uncertainty, businesses must adopt proactive measures to navigate the evolving landscape of market volatility and shifting trade policies. Key strategies should include enhancing market surveillance to monitor fluctuations in the bond market and currency exchange rates. This real-time awareness can empower companies to make informed decisions regarding pricing and procurement. Additionally, fostering diversification in supply chains can significantly mitigate risks associated with potential tariff increases. By sourcing from multiple countries and suppliers, businesses can cushion the impact of sudden policy changes and maintain operational resilience.

Moreover, clear interaction with stakeholders is essential. Companies should consider implementing a robust risk assessment framework that evaluates how changes in trade policy might affect their operations.This framework can include:

- Regular updates on trade agreements and tariffs

- Impact analyses on cost structures

- Contingency plans to address financial exposures

Creating an agile organizational structure that allows for quick pivoting in response to market developments will also be crucial. By prioritizing adaptability and transparent dialog, businesses can better weather the uncertainties posed by both domestic and international economic shifts.

Concluding Remarks

the recent fluctuations in the US bond market appear to have played a pivotal role in President Trump’s decision to halt plans for implementing higher tariffs. As concerns over inflation and market stability loom large, the administration’s strategic pause signals a keen awareness of the potential repercussions on the broader economy. The intricate link between fiscal policy and market dynamics continues to unfold, and economists will be watching closely to see how this decision impacts investor confidence and the overall trajectory of trade relations. As the landscape evolves, it remains essential for stakeholders to stay informed and prepared for the challenges that lie ahead in both the bond market and the international trade arena.