U.S. Tariffs Set to Trigger Unprecedented Trade Diversion

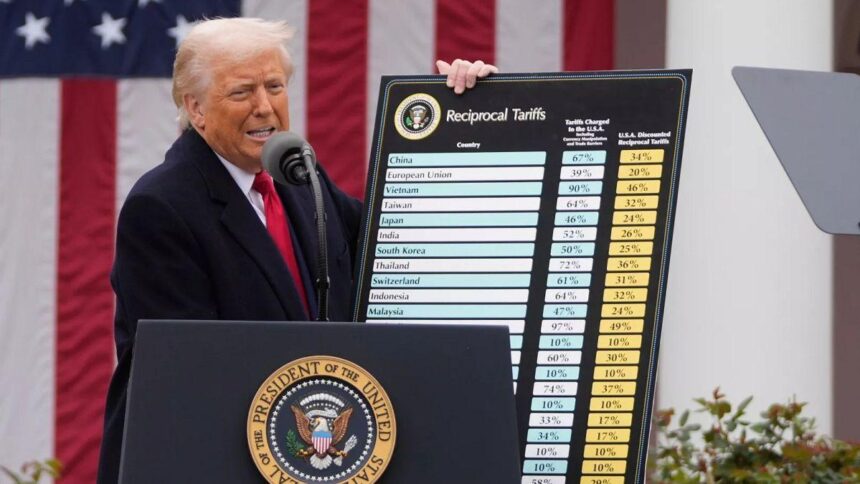

As the United States intensifies its tariff measures in a bid to protect domestic industries and reshape its trade relationships, experts warn that the global economy is on the brink of experiencing the greatest trade diversion in history. With new tariffs targeting a wide array of goods imported from key trading partners, businesses are strategically re-evaluating thier supply chains and seeking choice market routes. This shift could not only reshape international trade dynamics but also have profound implications for economies worldwide. As nations scramble to adapt to the changing landscape, the ripple effects of American trade policy will be felt far beyond its borders, sparking both opportunities and challenges across the globe. in this article,we explore the potential impacts of these tariffs and the emerging trends in global trade that could redefine the way countries interact economically.

Assessing the Immediate impact of U.S. Tariffs on Global Trade Dynamics

The recent implementation of U.S. tariffs has begun to reshape global trade dynamics, causing a ripple effect that extends far beyond American borders. Companies that once relied on established supply chains are now forced to rethink their strategies as they navigate the complexities of increased costs and shifting market access. The primary outcomes of these tariffs can be summarized as:

- Redirection of Trade Flows: Nations are adjusting their export-import patterns, seeking new markets to mitigate the impact of the tariffs.

- increased Production costs: Domestic producers, while initially benefitting from tariffs shielding them from foreign competition, may ultimately face higher costs passed down from suppliers who rely on imported materials.

- Heightened Economic Uncertainty: Business confidence is wavering as industries brace for retaliatory measures that could exacerbate an already precarious international climate.

As countries strategize their countermeasures,it becomes increasingly evident that this trade diversion could lead to significant alterations in global economic alliances. A closer look at expected trade patterns emphasizes these shifts:

| Country | Expected Trade Growth (%) | New Trade Partnerships |

|---|---|---|

| Mexico | 15 | South America, Asia |

| Vietnam | 20 | Japan, Europe |

| India | 10 | Africa, Middle East |

Such trends underline how tariffs are not merely an American policy but a catalyst for an intricate reconfiguration of global trade. As nations pivot and adapt to new realities, the landscape of international commerce stands on the brink of transformation, with businesses now reinventing themselves to thrive amid the shifting tides.

Strategies for Businesses to Navigate the Looming trade Diversion

The impending trade diversion necessitates that businesses adopt proactive measures to safeguard their interests and remain competitive. First, companies should diversify their supply chains to mitigate risks associated with reliance on any single market. By sourcing materials and products from multiple countries, businesses can reduce vulnerability to tariffs and other trade pressures. furthermore, exploring alternative regions such as Southeast Asia, Africa, and Latin America can uncover new partnerships that foster resilience and create opportunities for growth.

In addition, firms must enhance their market intelligence capabilities. Understanding the shifts in trade dynamics and consumer behaviour will empower businesses to adapt more swiftly. This includes investing in sophisticated data analytics to monitor emerging trends and intercept potential disruption signals. Companies should also engage in robust scenario planning to prepare for various outcomes related to trade policies. This strategic foresight will facilitate informed decision-making and allow businesses to navigate the complexities of a rapidly changing trade environment.

Emerging Markets: Opportunities and Risks Amidst Shifting Trade Patterns

As U.S. tariffs reshape global trade dynamics, emerging markets are presented with both significant opportunities and formidable risks. Countries that were previously sidelined in favor of more established trading partners now find themselves at the forefront of a possible trade renaissance. For instance, nations in Southeast Asia and Africa are attracting foreign investment as companies seek to realign their supply chains. The benefits are clear:

- Increased Foreign Direct Investment (FDI): As American companies look for alternative sources,many are setting their sights on emerging economies.

- Diversified Supply Chains: Countries such as Vietnam and India may seize the moment to become key players in manufacturing and export.

- Market Access: For several of these nations, improved infrastructure and trade agreements could facilitate entry into new markets.

However,this shift is not devoid of cautionary tales. Emerging markets remain vulnerable to several risks that could thwart their ascent. Economic instability, dependency on raw material exports, and noneconomic factors like political unrest pose significant challenges. Moreover, the transition to a new trade landscape demands adaptability and resilience:

- Fluctuating Currency Values: Currency volatility can impact profits and pricing strategies for businesses.

- Infrastructure Shortfalls: Many emerging markets may struggle to ramp up production and distribution quickly enough to meet new demand.

- Geopolitical Tensions: Engaging in new trade partnerships may lead to conflicts with existing allies or trading blocs.

| Chance | Risk |

|---|---|

| Foreign Direct Investment | Economic Instability |

| Diverse Markets | Political Unrest |

| Manufacturing Growth | Infrastructure Challenges |

Key Takeaways

As the implications of U.S. tariffs begin to unfold, the potential for unprecedented trade diversion looms larger than ever. The ripple effects of these policies not only threaten to reshape global supply chains but also challenge the very framework of international trade as we know it. Stakeholders across various industries are bracing for the seismic shifts that could redefine markets and alter economic alliances in ways that have yet to be fully realized.

With countries seeking alternative trade partners and reevaluating their export strategies, the stage is set for a dramatic reconfiguration of global commerce. The consequences of this trade diversion will likely influence economic growth, employment patterns, and diplomatic relations for years to come. As we move forward,it remains crucial for policymakers,businesses,and consumers to stay informed and adaptable in the face of these changes. The coming months will be pivotal in determining how far-reaching the impact of U.S. tariffs will be—and how nations will navigate this evolving landscape.