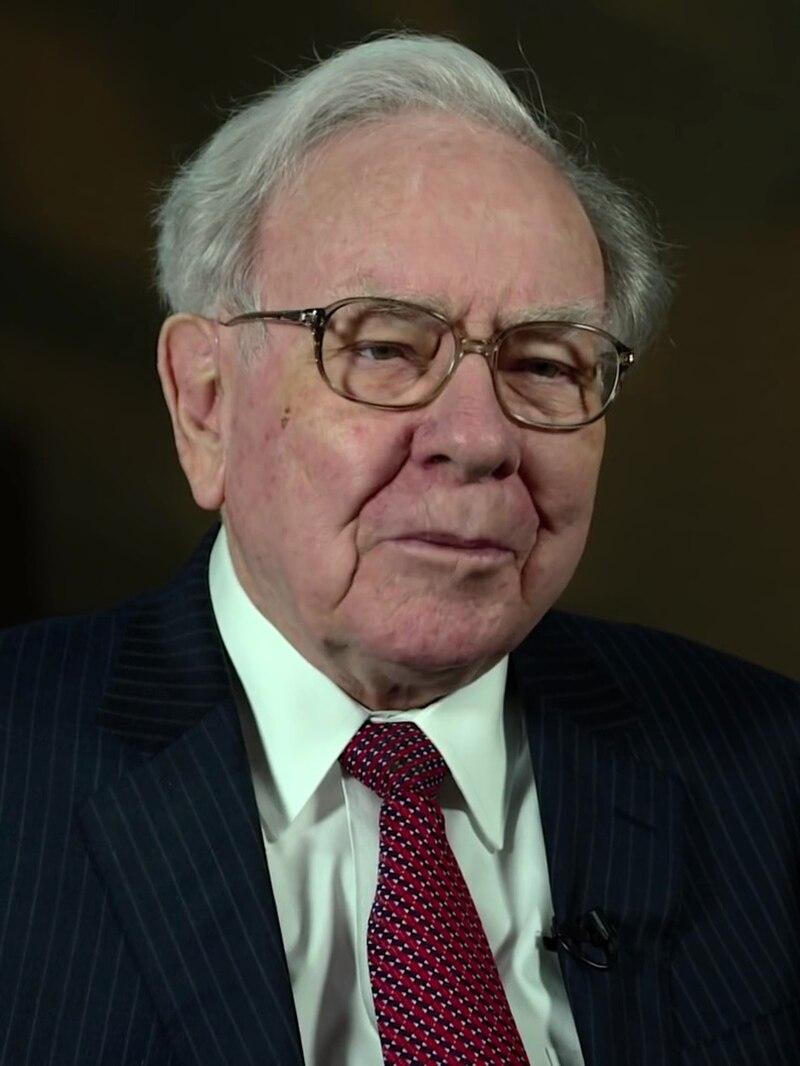

Warren Buffett’s Investment Philosophy: Navigating Change in a Modern Market

As Warren Buffett nears the end of his remarkable investment journey, a pressing question arises among financial experts and casual investors: can his established investment strategies adapt to the evolving landscape of today’s markets? Renowned for his value-oriented tactics and long-term vision, Buffett’s methodologies have significantly influenced investment practices over the years. However, with younger investors gravitating towards more innovative approaches such as algorithmic trading and cryptocurrencies, the relevance of Buffett’s principles is under increasing examination. This article explores the implications of Buffett’s potential retirement while assessing how his investing philosophy may fare in an ever-changing financial environment.

Buffett’s Legacy: The Future of Value Investing

The impending conclusion of Warren Buffett’s investing career raises critical questions about whether his value-investing philosophy will endure through time. His buy-and-hold strategy focuses on acquiring undervalued companies with solid fundamentals. Today’s investors find themselves at a pivotal juncture characterized by two distinct perspectives:

- Enduring Relevance: Many argue that as long as companies maintain intrinsic value, Buffett’s principles will continue to be applicable.

- Evolving Market Challenges: Conversely, some contend that rapid technological changes and shifting consumer preferences necessitate a reassessment of traditional valuation metrics.

A comparative analysis reveals how various investment styles perform in today’s market context. Below is an overview contrasting value investing with growth investing based on their annualized returns over the last decade:

| Investment Style | Annualized Return (10 Years) |

|---|---|

| Value Investing | 8.5% |

| Growth Investing | 12.3% |

This data indicates that while growth investing currently leads in performance metrics, it is crucial to recognize market trends’ cyclical nature. Historically, value investing has demonstrated resilience during economic downturns; advocates for this approach encourage newer generations to adopt a long-term perspective—highlighting that steadfast principles often yield significant rewards over time.

Adapting to Modern Market Dynamics: The Resilience of Buffett’s Strategies

The entry of new investor demographics into the marketplace has prompted scrutiny regarding Warren Buffett’s strategies amid rapidly changing market dynamics. The emergence of technology-driven trading platforms and social media influencers has transformed traditional investment landscapes; retail investors now enjoy unprecedented access to tools and information that often prioritize short-term gains rather than adhering to Buffet’s foundational long-term approach.

Moreover, this urgency for quick profits starkly contrasts with Buffet’s emphasis on thorough analysis before making investments—raising questions about whether his focus on fundamental values can still resonate amidst swift market fluctuations.

Navigating these new trends does not negate several core tenets from Buffet’s strategy which remain relevant when viewed through a contemporary lens:

- Critical Value Assessment: Ongoing evaluation of intrinsic company values serves as protection against volatility.

- Sustained Long-Term Focus: Concentrating on sustainable growth rather than fleeting trends enables steady wealth accumulation.

- Selecting Quality Businesses: Prioritizing investments in firms with strong management teams and competitive advantages remains prudent regardless of market conditions.

A comparison table below illustrates how Buffet’s philosophies align with modern contexts across different investment strategies:

| Investment Strategy | Buffett’s Approach | Modern Trend | Long-Term | Short-Term |

|---|---|---|

| Fundamental | Sentiment-Driven | |

| < aspect > th >< th >< TraditionalInvesting > th >< th >< ModernApproach > th > tr > head > |

|---|